Search

Search for projects by name or address

Blast

Blast

Badges

About

Blast is an EVM-compatible Optimistic Rollup supporting native yield. It invests funds deposited into the L1 bridge into various DeFi protocols transferring yield back to the L2.

Badges

About

Blast is an EVM-compatible Optimistic Rollup supporting native yield. It invests funds deposited into the L1 bridge into various DeFi protocols transferring yield back to the L2.

Why is the project listed in others?

Consequence: projects without a proper proof system fully rely on single entities to safely update the state. A malicious proposer can finalize an invalid state, which can cause loss of funds.

Learn more about the recategorisation here.

2025 Feb 09 — 2026 Feb 09

The section shows the operating costs that L2s pay to Ethereum.

2025 Feb 09 — 2026 Feb 09

This section shows how much data the project publishes to its data-availability (DA) layer over time. The project currently posts data to![]() Ethereum.

Ethereum.

2025 Feb 09 — 2026 Feb 09

This section shows how "live" the project's operators are by displaying how frequently they submit transactions of the selected type. It also highlights anomalies - significant deviations from their typical schedule.

Blast Mainnet starts using blobs

2024 May 27th

Blast Mainnet starts publishing data to blobs.

Blast upgrades to censor exploiter

2024 Mar 26th

The Munchables exploiter is prohibited from forcing transactions.

Funds can be stolen if

Funds can be frozen if

MEV can be extracted if

Currently the system permits invalid state roots. More details in project overview.

All of the data needed for proof construction is published on Ethereum L1.

There is no window for users to exit in case of an unwanted regular upgrade since contracts are instantly upgradable.

Only the whitelisted proposers can publish state roots on L1, so in the event of failure the withdrawals are frozen.

All data required for proofs is published on chain

All the data that is used to construct the system state is published on chain in the form of cheap blobs or calldata. This ensures that it will be available for enough time.

- Derivation: Batch submission - OP Mainnet specs

- BatchInbox - address

- OptimismPortal.sol - source code, depositTransaction function

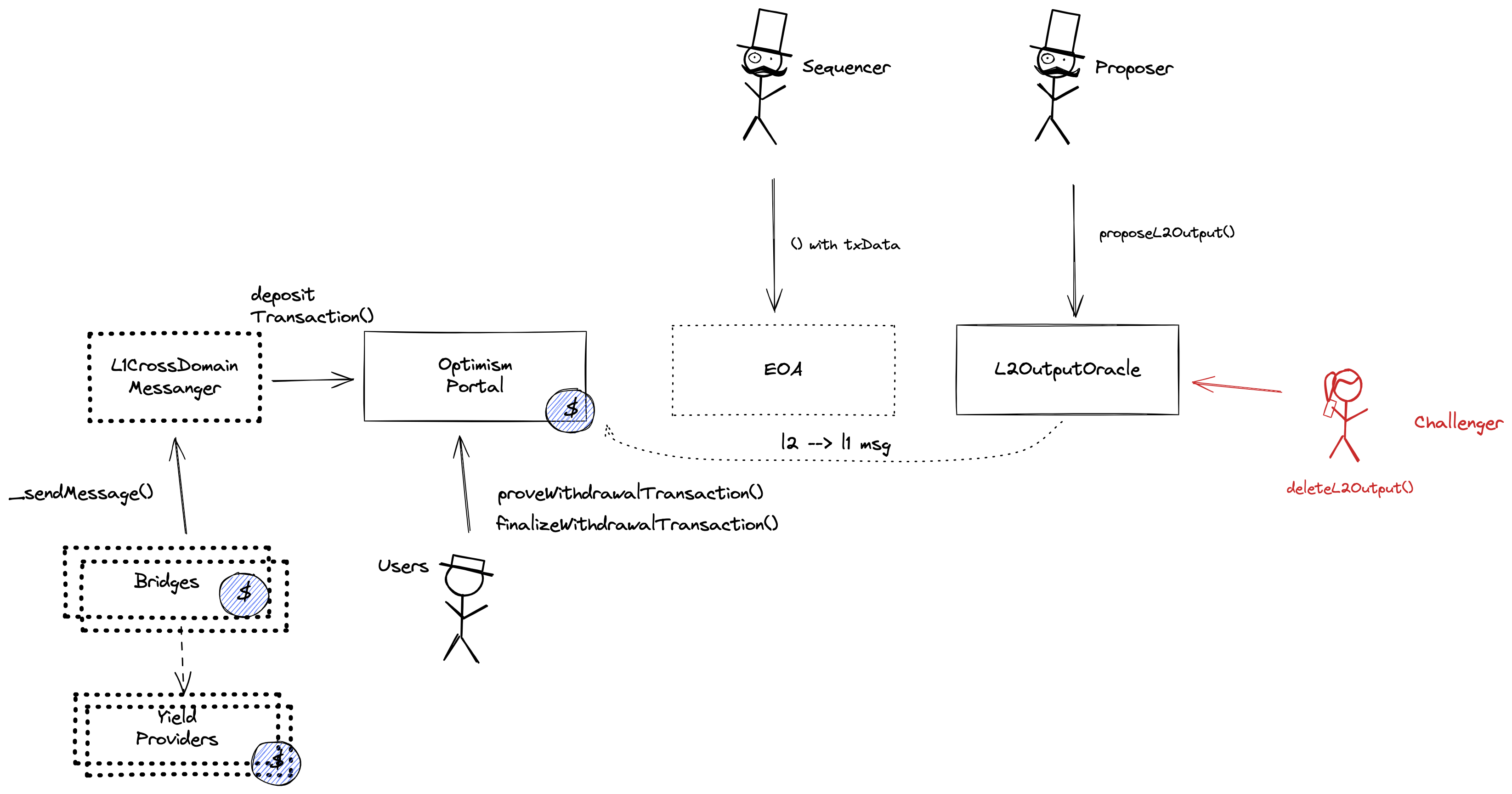

OP Stack projects can use the OP fault proof system, already being deployed on some. This project though is not using fault proofs yet and is relying on the honesty of the permissioned Proposer and Challengers to ensure state correctness. The smart contract system permits invalid state roots.

Funds can be stolen if an invalid state root is submitted to the system (CRITICAL).

The system has a centralized operator

MEV can be extracted if the operator exploits their centralized position and frontruns user transactions.

Users can force any transaction

Because the state of the system is based on transactions submitted on the underlying host chain and anyone can submit their transactions there it allows the users to circumvent censorship by interacting with the smart contract on the host chain directly.

Regular exit

The user initiates the withdrawal by submitting a regular transaction on this chain. When the block containing that transaction is settled the funds become available for withdrawal on L1. The process of block finalization takes a challenge period of 7d to complete. Once funds are added to the withdrawal queue, operator must ensure there is enough liquidity for withdrawals. If not, they need to reclaim tokens from Yield Providers.

Funds can lose value if there is a hack or the yield goes negative for yield providers (CRITICAL).

Funds can be frozen if there is not enough liquidity in the bridge, transactions are locked in withdrawal queue (CRITICAL).

Forced messaging

If the user experiences censorship from the operator with regular L2->L1 messaging they can submit their messages directly on L1. The system is then obliged to service this request or halt all messages, including forced withdrawals from L1 and regular messages initiated on L2. Once the force operation is submitted and if the request is serviced, the operation follows the flow of a regular message.

EVM compatible smart contracts are supported

OP stack chains are pursuing the EVM Equivalence model. No changes to smart contracts are required regardless of the language they are written in, i.e. anything deployed on L1 can be deployed on L2.

Ethereum

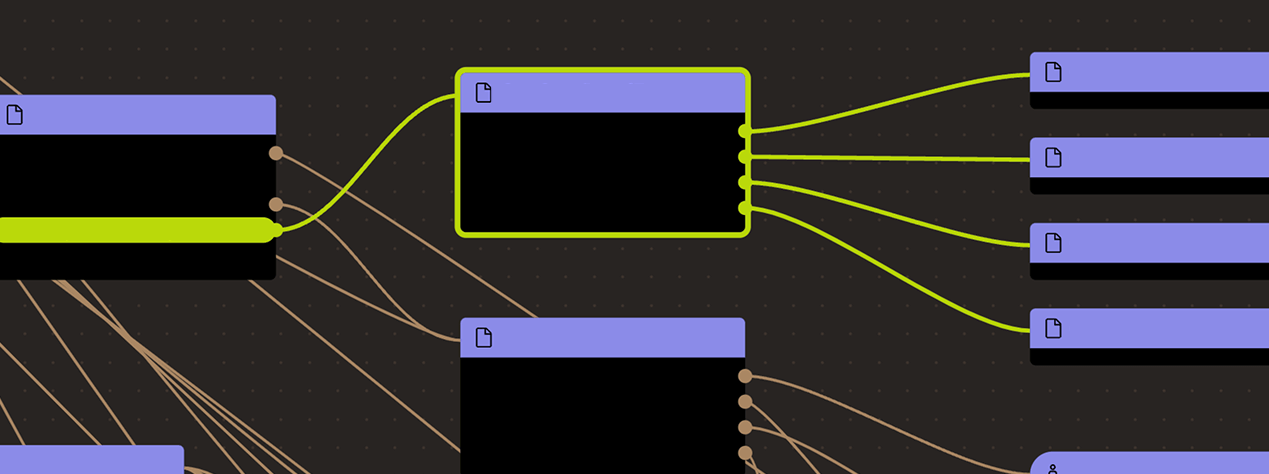

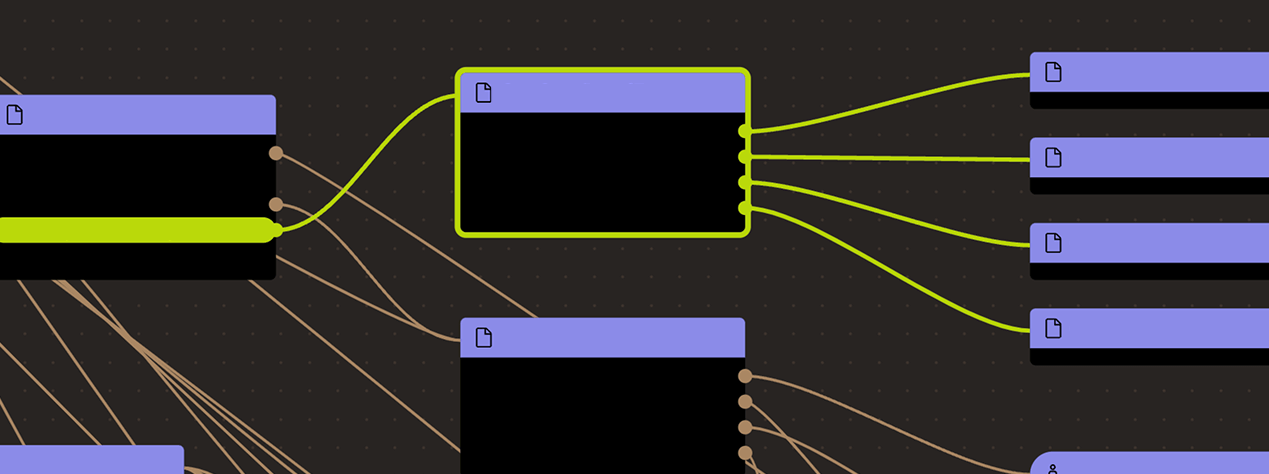

Roles:

Allowed to challenge or delete state roots proposed by a Proposer.

Allowed to pause withdrawals. In op stack systems with a proof system, the Guardian can also blacklist dispute games and set the respected game type (permissioned / permissionless).

Allowed to post new state roots of the current layer to the host chain.

Allowed to commit transactions from the current layer to the host chain.

Actors:

A Multisig with 3/5 threshold.

- Can upgrade with no delay

- OptimismPortal ProxyAdmin

- L1BlastBridge ProxyAdmin

- SystemConfig ProxyAdmin

- L1CrossDomainMessenger ProxyAdmin

- L1StandardBridge ProxyAdmin

- OptimismMintableERC20Factory ProxyAdmin

- L2OutputOracle ProxyAdmin

- ETHYieldManager ProxyAdmin

- USDYieldManager ProxyAdmin

- L1ERC721Bridge ProxyAdmin

- Can interact with SystemConfig

- Can interact with AddressManager

- set and change address mappings ProxyAdmin

- A Challenger - acting directly

- A Guardian - acting directly

A Multisig with 3/5 threshold.

- Can upgrade with no delay

- LaunchBridge

- A Proposer - acting directly

- A Sequencer - acting directly

Ethereum

The main entry point to deposit funds from host chain to this chain. It also allows to prove and finalize withdrawals.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

- guardian: BlastMultisig 1

- This contract stores the following tokens: ETH.

Contains a list of proposed state roots which Proposers assert to be a result of block execution. Currently only the PROPOSER address can submit new state roots.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

- challenger: BlastMultisig 1

- proposer: EOA 1

Sends messages from host chain to this chain, and relays messages back onto host chain. In the event that a message sent from host chain to this chain is rejected for exceeding this chain’s epoch gas limit, it can be resubmitted via this contract’s replay function.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

The main entry point to deposit ERC20 tokens from host chain to this chain.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

- This contract can store any token.

Used to bridge ERC-721 tokens from host chain to this chain.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

Yield Provider for DAI investing DAI into the MakerDAO DSR.

- Roles:

- owner: BlastMultisig 1

Yield Provider for ETH investing ETH into stETH.

- Roles:

- admin: BlastMultisig 2

- This contract stores the following tokens: stETH.

A helper contract that generates OptimismMintableERC20 contracts on the network it’s deployed to. OptimismMintableERC20 is a standard extension of the base ERC20 token contract designed to allow the L1StandardBridge contracts to mint and burn tokens. This makes it possible to use an OptimismMintableERC20 as this chain’s representation of a token on the host chain, or vice-versa.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

Contract managing Yield Providers for ETH.

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

- This contract stores the following tokens: ETH, stETH.

Contract escrowing stablecoins and managing Yield Providers for stablecoins (like for example DAI).

- Roles:

- admin: ProxyAdmin; ultimately BlastMultisig 1

Value Secured is calculated based on these smart contracts and tokens:

Main entry point for users depositing ERC20 token that do not require custom gateway.

Escrow for ETH that is invested into yield-bearing contracts such as stETH.

Main entry point for users depositing ETH.

Pre-launch Blast Vault that keeps stETH. Funds from this Vault can be migrated to Blast bridge.

The current deployment carries some associated risks:

Funds can be stolen if a contract receives a malicious code upgrade. There is no delay on code upgrades (CRITICAL).