Search

Search for projects by name or address

Layer2.Finance

Layer2.Finance

Badges

About

Layer2.Finance aims to democratize access to DeFi protocols for everyone. Users can aggregate their DeFi usage and save on Ethereum fees.

About

Layer2.Finance aims to democratize access to DeFi protocols for everyone. Users can aggregate their DeFi usage and save on Ethereum fees.

Funds can be stolen if

The information in the section might be incomplete or outdated.

The L2BEAT Team is working to research & validate the content before publishing.

This risk is currently under review.

This risk is currently under review.

This risk is currently under review.

This risk is currently under review.

This risk is currently under review.

The information in the section might be incomplete or outdated.

The L2BEAT Team is working to research & validate the content before publishing.

Layer2.Finance's stage is currently

IN REVIEWThe information in the section might be incomplete or outdated.

The L2BEAT Team is working to research & validate the content before publishing.

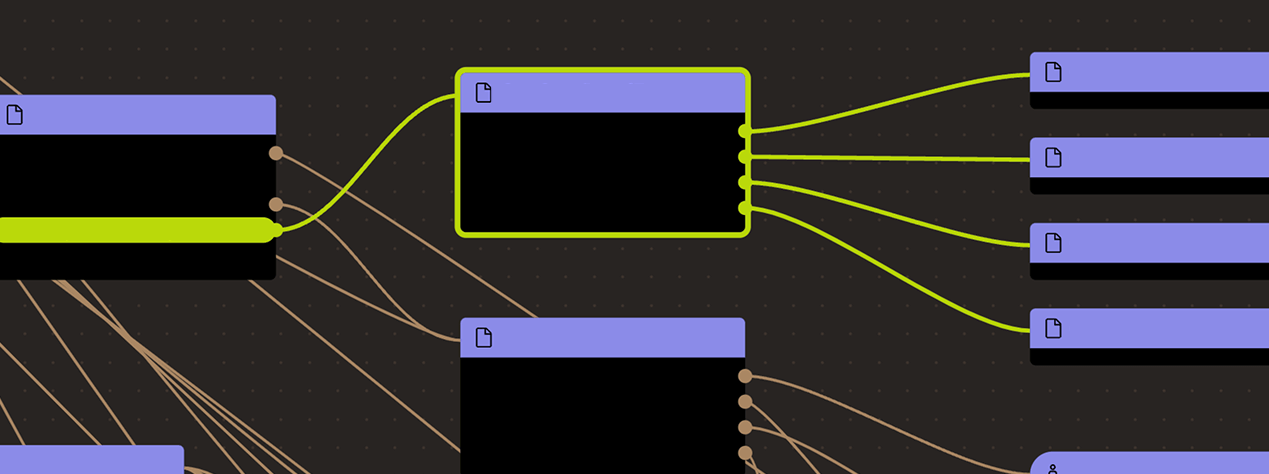

Ethereum

This contract stores the following tokens: BUSD, DAI, USDC, USDT, WETH.

The current deployment carries some associated risks:

Funds can be stolen if the owner calls owner-only functions that pause the contract and drain funds (CRITICAL).