Search

Search for projects by name or address

Manta Pacific

Manta Pacific

Badges

About

Manta Pacific is an Optimium empowering EVM-native zero-knowledge (ZK) applications and general dapps.

Badges

About

Manta Pacific is an Optimium empowering EVM-native zero-knowledge (ZK) applications and general dapps.

Why is the project listed in others?

Consequence: projects without a proper proof system fully rely on single entities to safely update the state. A malicious proposer can finalize an invalid state, which can cause loss of funds.

Consequence: projects without a data availability bridge fully rely on single entities (the sequencer) to honestly rely available data roots on Ethereum. A malicious sequencer can collude with the proposer to finalize an unavailable state, which can cause loss of funds.

Learn more about the recategorisation here.

2025 Mar 08 — 2026 Mar 08

The section shows the operating costs that L2s pay to Ethereum.

2025 Mar 08 — 2026 Mar 08

This section shows how much data the project publishes to its data-availability (DA) layer over time. The project currently posts data to![]() Celestia.

Celestia.

2025 Mar 08 — 2026 Mar 08

This section shows how "live" the project's operators are by displaying how frequently they submit transactions of the selected type. It also highlights anomalies - significant deviations from their typical schedule.

Funds can be stolen if

Funds can be lost if

Funds can be frozen if

MEV can be extracted if

Currently the system permits invalid state roots. More details in project overview.

Proof construction and state derivation fully rely on data that is posted on Celestia. Sequencer tx roots are not checked against the Blobstream bridge data roots onchain, but L2 nodes can verify data availability by running a Celestia light client.

There is no window for users to exit in case of an unwanted regular upgrade since contracts are instantly upgradable.

Only the whitelisted proposers can publish state roots on L1, so in the event of failure the withdrawals are frozen.

Data is posted to Celestia

Transactions roots are posted onchain and the full data is posted on Celestia. Since the Blobstream bridge is not used, availability of the data is not verified against Celestia validators, meaning that the Sequencer can single-handedly publish unavailable roots. If Celestia becomes unavailable, the sequencer falls back to Ethereum.

Funds can be lost if the sequencer posts an unavailable transaction root (CRITICAL).

Funds can be lost if the data is not available on the external provider (CRITICAL).

- Introducing Blobstream: streaming modular DA to Ethereum

- Derivation: Batch submission - OP Mainnet specs

- BatchInbox - address

- OptimismPortal.sol - source code, depositTransaction function

OP Stack projects can use the OP fault proof system, already being deployed on some. This project though is not using fault proofs yet and is relying on the honesty of the permissioned Proposer and Challengers to ensure state correctness. The smart contract system permits invalid state roots.

Funds can be stolen if an invalid state root is submitted to the system (CRITICAL).

The system has a centralized operator

MEV can be extracted if the operator exploits their centralized position and frontruns user transactions.

Users can force any transaction

Because the state of the system is based on transactions submitted on the underlying host chain and anyone can submit their transactions there it allows the users to circumvent censorship by interacting with the smart contract on the host chain directly.

Regular messaging

Funds can be frozen if the centralized validator goes down. Users cannot produce blocks themselves and exiting the system requires new block production (CRITICAL).

Forced messaging

If the user experiences censorship from the operator with regular L2->L1 messaging they can submit their messages directly on L1. The system is then obliged to service this request or halt all messages, including forced withdrawals from L1 and regular messages initiated on L2. Once the force operation is submitted and if the request is serviced, the operation follows the flow of a regular message.

EVM compatible smart contracts are supported

OP stack chains are pursuing the EVM Equivalence model. No changes to smart contracts are required regardless of the language they are written in, i.e. anything deployed on L1 can be deployed on L2.

Ethereum

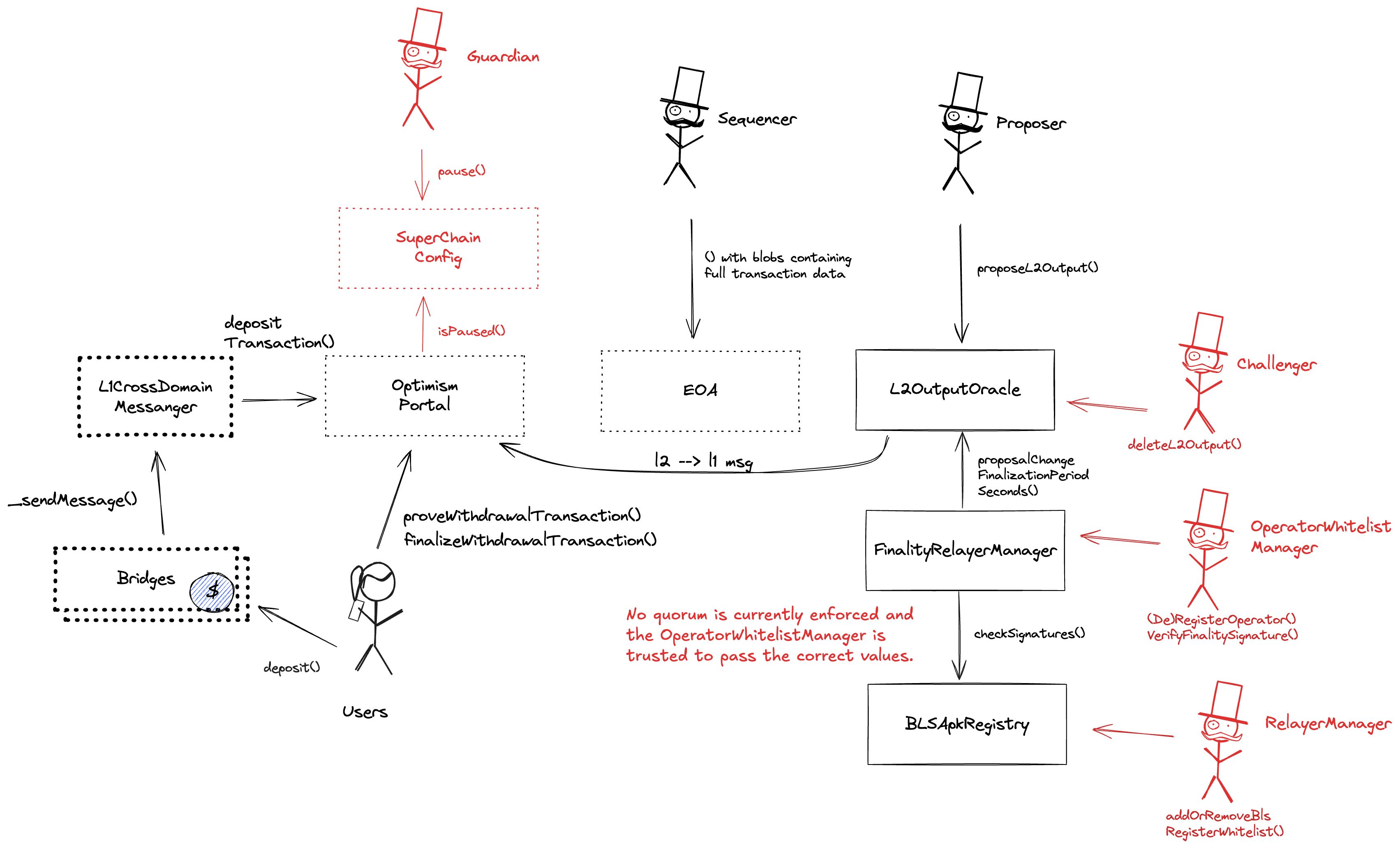

Roles:

Allowed to challenge or delete state roots proposed by a Proposer.

Allowed to pause withdrawals. In op stack systems with a proof system, the Guardian can also blacklist dispute games and set the respected game type (permissioned / permissionless).

Allowed to post new state roots of the current layer to the host chain.

Allowed to commit transactions from the current layer to the host chain.

Actors:

A Multisig with 5/7 threshold.

- Can upgrade with no delay

- L2OutputOracle ProxyAdmin

- L1StandardBridge ProxyAdmin

- L1CrossDomainMessenger ProxyAdmin

- SystemConfig ProxyAdmin

- OptimismPortal ProxyAdmin

- Can interact with AddressManager

- set and change address mappings ProxyAdmin

Contract managing challenge period reductions based on whitelisted signer and staked amounts. No threshold is currently enforced and no validation is done on the staked amounts. The current challenge period is set to 3d, the manta quorum can reduce it by a maximum of 1d, the bitcoin quorum can reduce it by a maximum of 1d, and the minimum challenge period allowed is set to 12h.

- Can interact with L2OutputOracle

- can reduce the challenge period for selected state roots

- Can upgrade with no delay

- BLSApkRegistry

- Can upgrade with no delay

- FinalityRelayerManager

- A Proposer - acting directly

- A Sequencer - acting directly

- Can interact with FinalityRelayerManager

- can vote for challenge period reductions

- Can interact with FinalityRelayerManager

- can add or remove operators, set the target for manta and bitcoin votes, and provide data for signature validation, including addresses to be excluded from validation

- Can interact with BLSApkRegistry

- it can add or remove whitelisted addresses that can register BLS keys

Ethereum

Contains a list of proposed state roots which Proposers assert to be a result of block execution. Currently only the PROPOSER address can submit new state roots. The challenge period can be reduced by the FinalityRelayerManager contract.

- Roles:

- admin: ProxyAdmin; ultimately MantaMultisig

- challenger: EOA 1

- finalityProvider: FinalityRelayerManager

- proposer: EOA 2

The main entry point to deposit funds from host chain to this chain. It also allows to prove and finalize withdrawals.

- Roles:

- admin: ProxyAdmin; ultimately MantaMultisig

- guardian: EOA 1

The main entry point to deposit ERC20 tokens from host chain to this chain.

- Roles:

- admin: ProxyAdmin; ultimately MantaMultisig

All supported tokens in this escrow are included in the value secured calculation.

Sends messages from host chain to this chain, and relays messages back onto host chain. In the event that a message sent from host chain to this chain is rejected for exceeding this chain’s epoch gas limit, it can be resubmitted via this contract’s replay function.

- Roles:

- admin: ProxyAdmin; ultimately MantaMultisig

- Roles:

- owner: MantaMultisig

Contract used to register BLS keys and verify aggregated signatures. No specific threshold is enforced here, as all addresses to exclude from the signature check are provided as an input.

- Roles:

- admin:

- relayerManager: EOA 7

The current deployment carries some associated risks:

Funds can be stolen if a contract receives a malicious code upgrade. There is no delay on code upgrades (CRITICAL).

Funds can be stolen if the source code of unverified contracts contains malicious code (CRITICAL).