Arbitrum One

Arbitrum One

$16.48 B

0.48%

- Fraud proof submission is open only to whitelisted actors.

- Upgrades unrelated to on-chain provable bugs provide less than 30d to exit.

- The Security Council's actions are not confined to on-chain provable bugs.

...

Choose token

Arbitrum (ARB)

Arbitrum (ARB) USD Coin (USDC)

USD Coin (USDC) GMX (GMX)

GMX (GMX) Xai (XAI)

Xai (XAI) Radiant (RDNT)

Radiant (RDNT) Gains Network (GNS)

Gains Network (GNS) DMT (DMT)

DMT (DMT) Camelot token (GRAIL)

Camelot token (GRAIL) WINR (WINR)

WINR (WINR) JoeToken (JOE)

JoeToken (JOE) SPARTA (SPARTA)

SPARTA (SPARTA) VelaToken (VELA)

VelaToken (VELA) Hydranet (HDN)

Hydranet (HDN) Equation (EQU)

Equation (EQU) Graph Token (GRT)

Graph Token (GRT) Renzo Restaked ETH (ezETH)

Renzo Restaked ETH (ezETH) SmarDex Token (SDEX)

SmarDex Token (SDEX) Staked FRAX (sFRAX)

Staked FRAX (sFRAX) beefy.finance (BIFI)

beefy.finance (BIFI) Ether (ETH)

Ether (ETH) Tether USD (USDT)

Tether USD (USDT) Wrapped BTC (WBTC)

Wrapped BTC (WBTC) Wrapped eETH (weETH)

Wrapped eETH (weETH) USD Coin (USDC.e)

USD Coin (USDC.e) Wrapped liquid staked Ether 2.0 (wstETH)

Wrapped liquid staked Ether 2.0 (wstETH) MAGIC (MAGIC)

MAGIC (MAGIC) Vertex (VRTX)

Vertex (VRTX) Pendle (PENDLE)

Pendle (PENDLE) Marlin POND (POND)

Marlin POND (POND) ChainLink Token (LINK)

ChainLink Token (LINK) Dai Stablecoin (DAI)

Dai Stablecoin (DAI) Rocket Pool ETH (rETH)

Rocket Pool ETH (rETH) MUX Protocol (MCB)

MUX Protocol (MCB) Wootrade Network (WOO)

Wootrade Network (WOO)...

...

Nitro Upgrade

2022 Aug 31st

Upgrade is live, introducing new architecture, increased throughput and lower fees.

Odyssey paused

2022 Jun 29th

Due of the heavy load being put on the chain, Odyssey program got paused.

Mainnet for everyone

2021 Aug 31st

Whitelist got removed, there are no restrictions on who can transact with the network.

Funds can be stolen if

- none of the whitelisted verifiers checks the published state. Fraud proofs assume at least one honest and able validator (CRITICAL),

- a contract receives a malicious code upgrade. There is a 12d 8h delay on code upgrades,

- a contract receives a malicious code upgrade. There is a 12 days delay on code upgrades unless upgrade is initiated by the Security Council in which case there is no delay.

Funds can be lost if

MEV can be extracted if

State validation

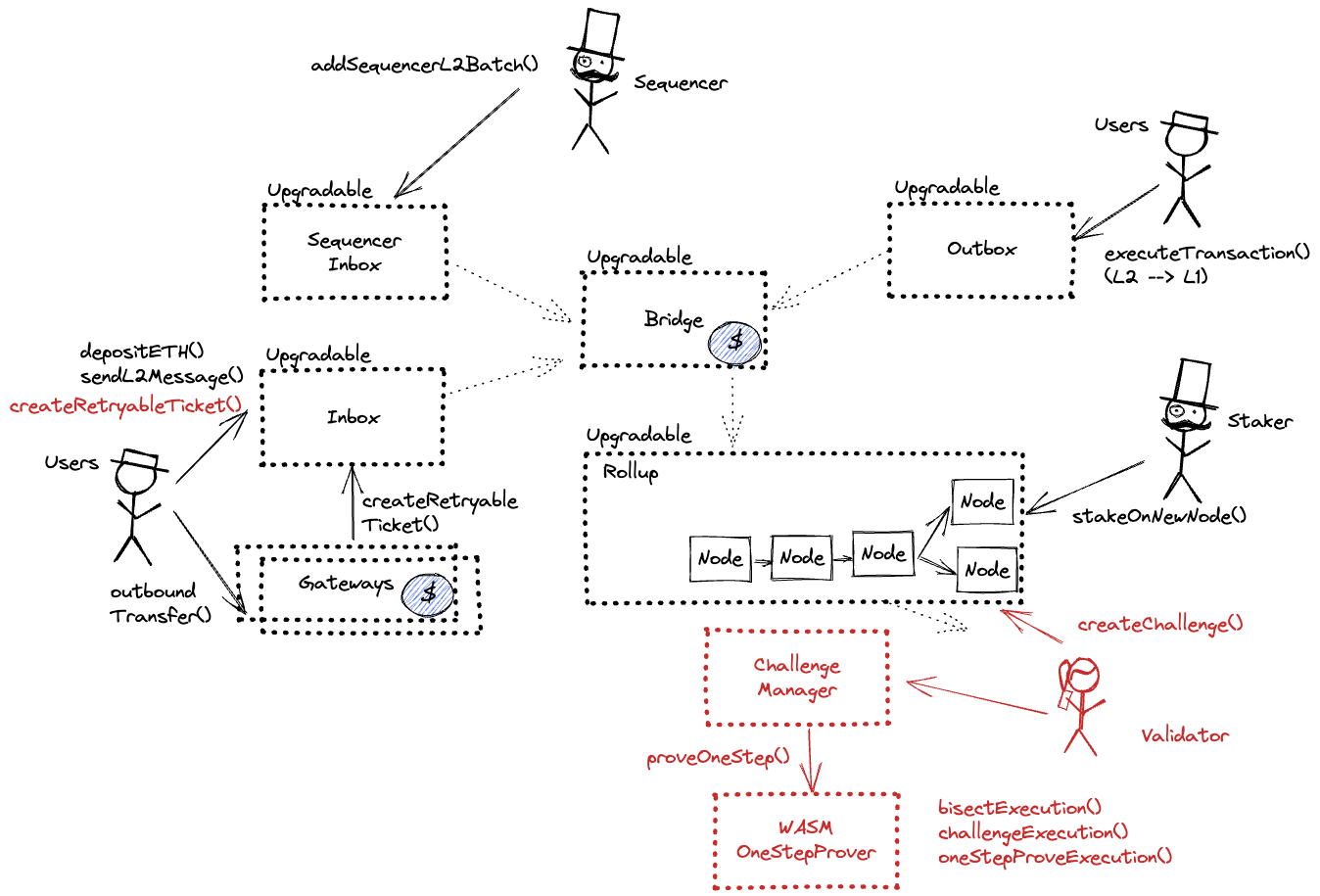

Fraud proofs (INT)Fraud proofs allow 14 WHITELISTED actors watching the chain to prove that the state is incorrect. Interactive proofs (INT) require multiple transactions over time to resolve.

Data availability

On chainAll of the data needed for proof construction is published on chain.

Exit window

2dUpgrades are initiated on L2 and have to go first through a 3d delay. Since there is a 1d to force a tx, users have only 2d to exit. If users post a tx after that time, they would need to self propose a root with a 6d 8h delay and then wait for the 6d 8h challenge window, while the upgrade would be confirmed just after the 6d 8h challenge window and the 3d L1 timelock.

Sequencer failure

Self sequenceIn the event of a sequencer failure, users can force transactions to be included in the project’s chain by sending them to L1. There is a 1d delay on this operation.

Proposer failure

Self proposeAnyone can become a Proposer after 6d 8h of inactivity from the currently whitelisted Proposers.

Fraud proofs ensure state correctness

After some period of time, the published state root is assumed to be correct. For a certain time period, one of the whitelisted actors can submit a fraud proof that shows that the state was incorrect. The challenge protocol can be subject to delay attacks.

Funds can be stolen if none of the whitelisted verifiers checks the published state. Fraud proofs assume at least one honest and able validator (CRITICAL).

All data required for proofs is published on chain

All the data that is used to construct the system state is published on chain in the form of cheap blobs or calldata. This ensures that it will be available for enough time.

The rollup node (Arbitrum Nitro) consists of three parts. The base layer is the core Geth server (with minor modifications to add hooks) that emulates the execution of EVM contracts and maintains Ethereum’s state. The middle layer, ArbOS, provides additional Layer 2 functionalities such as decompressing data batches, accounting for Layer 1 gas costs, and supporting cross-chain bridge functionalities. The top layer consists of node software, primarily from Geth, that handles client connections (i.e., regular RPC node). View Code

The Sequencer’s batches are compressed using a general-purpose data compression algorithm known as Brotli, configured to its highest compression setting.

They performed a regenesis from Classic to Nitro, and that file represents the last Classic state. To sync from the initial Classic state, instructions can be found here.

Nitro supports Ethereum’s data structures and formats by incorporating the core code of the popular go-ethereum (“Geth”) Ethereum node software. The batch is composed of a header and a compressed blob, which results from compressing concatenated RLP-encoded transactions using the standard RLP encoding.

The system has a centralized sequencer

While proposing blocks is open to anyone the system employs a privileged sequencer that has priority for submitting transaction batches and ordering transactions.

MEV can be extracted if the operator exploits their centralized position and frontruns user transactions.

Users can force any transaction

Because the state of the system is based on transactions submitted on-chain and anyone can submit their transactions there it allows the users to circumvent censorship by interacting with the smart contract directly. Anyone can become a Proposer after approximately 6d 8h (45818 blocks) of inactivity from the currently whitelisted Proposers.

Regular exit

The user initiates the withdrawal by submitting a regular transaction on this chain. When the block containing that transaction is finalized the funds become available for withdrawal on L1. The process of block finalization usually takes several days to complete. Finally the user submits an L1 transaction to claim the funds. This transaction requires a merkle proof.

Tradeable Bridge Exit

When a user initiates a regular withdrawal a third party verifying the chain can offer to buy this withdrawal by paying the user on L1. The user will get the funds immediately, however the third party has to wait for the block to be finalized. This is implemented as a first party functionality inside Arbitrum’s token bridge.

Autonomous exit

Users can (eventually) exit the system by pushing the transaction on L1 and providing the corresponding state root. The only way to prevent such withdrawal is via an upgrade.

EVM compatible smart contracts are supported

Arbitrum One uses Nitro technology that allows running fraud proofs by executing EVM code on top of WASM.

Funds can be lost if there are mistakes in the highly complex Nitro and WASM one-step prover implementation.

Arbitrum DAO is in charge of upgrades

Arbitrum DAO allows $ARB token holders to propose and vote on changes to the organization and the technologies it governs. The governance smart contracts are implemented on Arbitrum One rollup chain. The DAO can upgrade the Arbitrum One contracts on L2 with 3d delay and - using L2 --> L1 Governance Relay, update contracts on L1 with additional 3d delay + 6d 8h delay for all L2 --> L1 messages (in total a delay of 12d 8h). The Security Council can upgrade the contracts without any delay. It can also cancel any upgrades initiated by the DAO.

Funds can be stolen if a contract receives a malicious code upgrade. There is a 12d 8h delay on code upgrades.

The system uses the following set of permissioned addresses:

The admin of all contracts in the system, capable of issuing upgrades without notice and delay. This allows it to censor transactions, upgrade bridge implementation potentially gaining access to all funds stored in a bridge and change the sequencer or any other system component (unlimited upgrade power). It is also the admin of the special purpose smart contracts used by validators. This is a Gnosis Safe with 9 / 12 threshold.

Those are the participants of the SecurityCouncil.

This contract is an admin of SequencerInbox, RollupEventInbox, Bridge, Outbox, Inbox and ChallengeManager contracts. It is owned by the Upgrade Executor.

This contract is an admin of the UpgradeExecutor contract, but is also owned by it. Can cancel Timelock’s proposals.

This is yet another proxy admin for the three gateway contracts. It is owned by the Upgrade Executor.

They can submit new state roots and challenge state roots. Some of the operators perform their duties through special purpose smart contracts.

Central actors allowed to submit transaction batches to L1.

It can update whether an address is authorized to be a batch poster at the sequencer inbox. The UpgradeExecutor retains the ability to update the batch poster manager (along with any batch posters). This is a Gnosis Safe with 4 / 6 threshold.

Those are the participants of the BatchPosterManagerMultisig.

The system consists of the following smart contracts:

Main contract implementing Arbitrum One Rollup. Manages other Rollup components, list of Stakers and Validators. Entry point for Validators creating new Rollup Nodes (state commits) and Challengers submitting fraud proofs.

Can be upgraded by: UpgradeExecutorAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Contract managing Inboxes and Outboxes. It escrows ETH sent to L2. This contract stores the following tokens: ETH.

Can be upgraded by: ArbitrumProxyAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Main entry point for the Sequencer submitting transaction batches to a Rollup.

Can be upgraded by: ArbitrumProxyAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Entry point for users depositing ETH and sending L1 --> L2 messages. Deposited ETH is escrowed in a Bridge contract.

Can be upgraded by: ArbitrumProxyAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Arbitrum’s Outbox system allows for arbitrary L2 to L1 contract calls; i.e., messages initiated from L2 which eventually resolve in execution on L1.

Can be upgraded by: ArbitrumProxyAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

This contract can upgrade the system’s contracts. The upgrades can be done either by the Security Council or by the L1ArbitrumTimelock.

Can be upgraded by: UpgradeExecutorAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Timelock contract for Arbitrum DAO Governance. It gives the DAO participants the ability to upgrade the system. Only the L2 counterpart of this contract can execute the upgrades.

Can be upgraded by: UpgradeExecutorAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Router managing token <–> gateway mapping.

Can be upgraded by: GatewaysAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Value Locked is calculated based on these smart contracts and tokens:

Main entry point for users depositing ERC20 tokens that require minting custom token on L2.

Can be upgraded by: GatewaysAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Main entry point for users depositing ERC20 tokens. Upon depositing, on L2 a generic, “wrapped” token will be minted.

Can be upgraded by: GatewaysAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

Contract managing Inboxes and Outboxes. It escrows ETH sent to L2.

Can be upgraded by: ArbitrumProxyAdmin

Upgrade delay: 12d 8h or 0 if overridden by Security Council

DAI Vault for custom DAI Gateway. Fully controlled by MakerDAO governance.

wstETH Vault for custom wstETH Gateway. Fully controlled by Lido governance.

The current deployment carries some associated risks:

Funds can be stolen if a contract receives a malicious code upgrade. There is a 12 days delay on code upgrades unless upgrade is initiated by the Security Council in which case there is no delay.